-

admin@bestybookkeepers.com

-

Call Us M-F 9-5pm ET: 833-44-BESTY

So, you've hit the major milestone of $500,000 in annual revenue. Congratulations! You're officially in the big leagues. But as you've probably realized, the strategies that got you here won't be enough to get you to the coveted 7-figure mark and beyond. Scaling a business is a different ballgame, and it requires a new level of financial discipline and strategic insight.

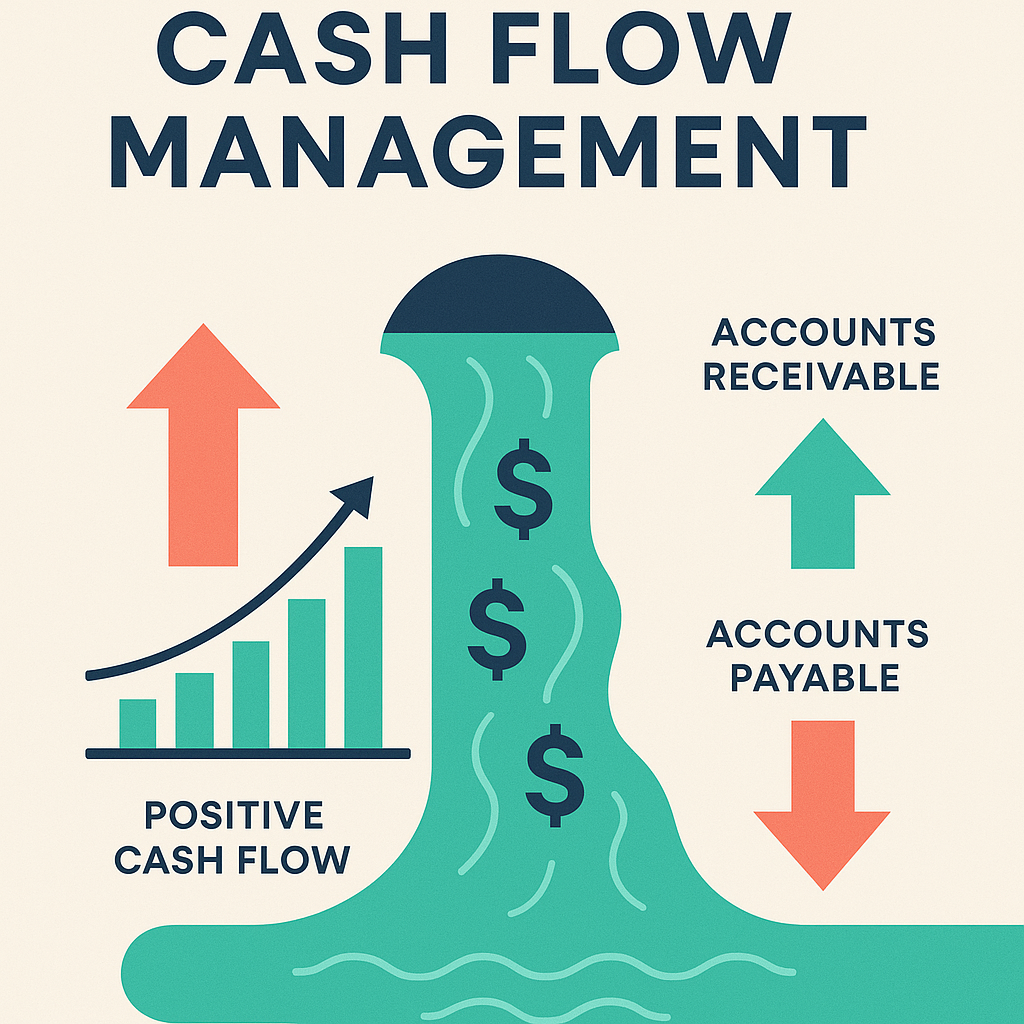

Many entrepreneurs at this stage get bogged down in the day-to-day grind, and they lose sight of the bigger financial picture. They're so focused on making sales that they neglect the very metrics that determine their long-term success. As a study by U.S. Bank revealed, a staggering 82% of small businesses fail due to cash flow issues—not because of a lack of sales, but because they lacked the financial clarity to make strategic decisions.

If you're a multi-business owner juggling multiple revenue streams, this challenge is even more pronounced. To successfully scale to 7 figures and beyond, you need to move beyond basic bookkeeping and start thinking like a CFO. That means focusing on the financial metrics that truly matter. In this article, we'll break down the three most critical financial metrics you need to master to scale your business sustainably.

It might sound obvious, but you'd be surprised how many entrepreneurs overlook the importance of cash flow. They see rising sales numbers and assume everything is fine, but they fail to realize that sales don't equal cash in the bank. As Bernhard Schroeder, a successful serial entrepreneur, notes in Forbes, “You can be doing a $1 million dollars a month in sales and go bankrupt.”

Why it matters for scaling: When you're scaling, your expenses often grow faster than your revenue. You're investing in new team members, marketing campaigns, and infrastructure. If you don't have a firm grip on your cash flow, you can quickly run into a cash crunch, even if your business is technically profitable.

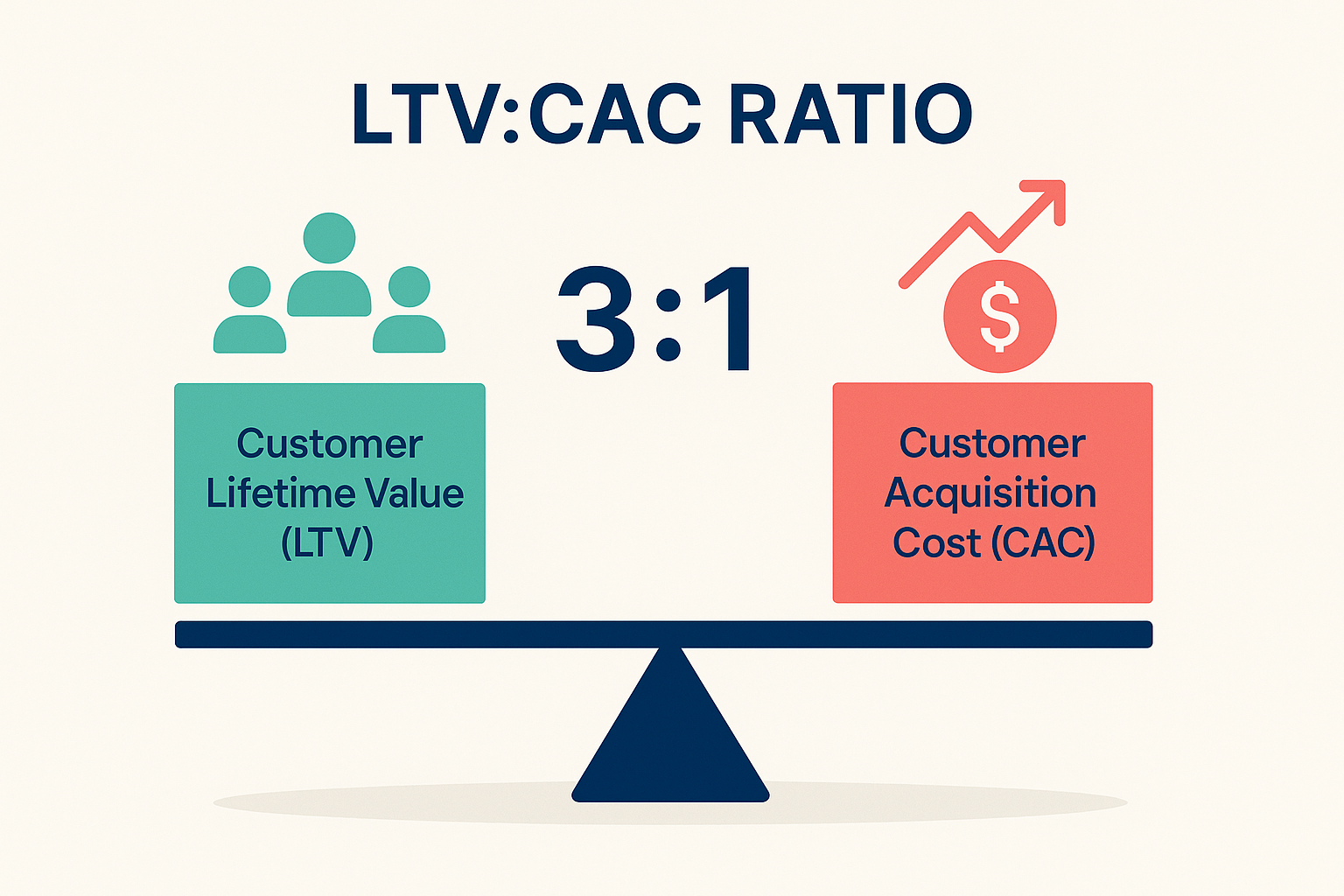

Scaling isn't just about acquiring new customers; it's about acquiring the right customers—the ones who will stick with you for the long haul and generate a positive return on your investment. The LTV to CAC ratio is the ultimate measure of your marketing and sales efficiency.

Why it matters for scaling: A healthy LTV to CAC ratio is the key to sustainable growth. If your CAC is higher than your LTV, you're losing money on every new customer you acquire. As you scale, this can quickly lead to financial disaster. According to Predictable Profits, a healthy LTV-to-CAC ratio is 3:1.

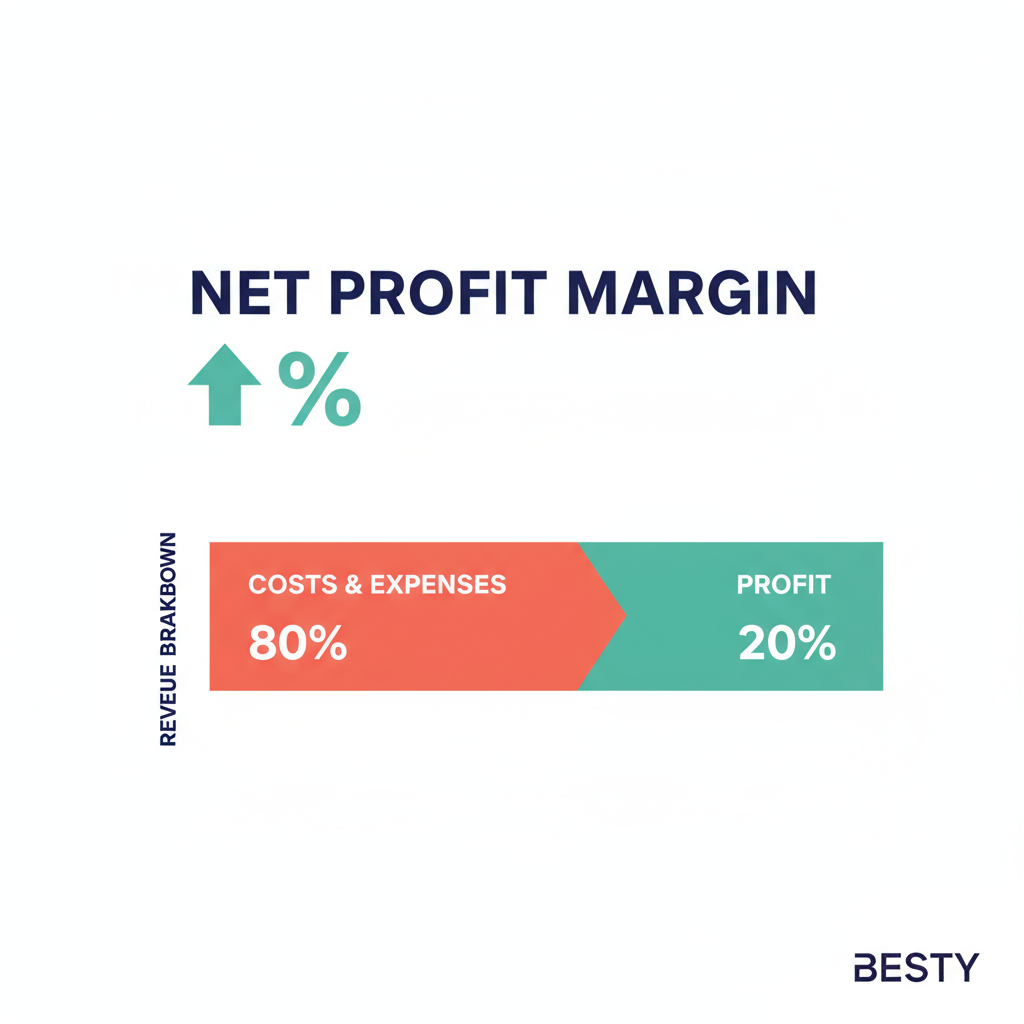

While revenue growth is exciting, it's not the only thing that matters. At the end of the day, the goal of any business is to make a profit. Your net profit margin tells you what percentage of your revenue is left over after you've paid all of your expenses, including taxes.

Why it matters for scaling: As you scale, your expenses will inevitably increase. If you're not careful, your profit margins can quickly erode, even as your revenue grows. Tracking your net profit margin ensures that you're scaling your business in a profitable and sustainable way.

At BESTY Bookkeepers, we understand that scaling a business is about more than just crunching numbers. It's about having the financial clarity and strategic insight to make bold, data-driven decisions. That's why we've designed our services specifically for multi-business owners who are ready to move beyond basic bookkeeping and start using their financials as a strategic weapon.

Our MoneyMatchIQ service is the perfect first step. For just $99, we'll conduct a comprehensive review of your financial records to identify hidden inefficiencies and opportunities for growth. From there, our team of expert bookkeepers and fractional CFOs can help you implement a customized financial strategy that's designed to help you scale your business to 7 figures and beyond.

Don't let financial uncertainty hold you back. Schedule your free strategic consultation today and let us help you build the financial foundation you need to achieve your growth goals.

Let BESTY Bookkeepers help you master the financial metrics that matter most. Our expert team specializes in helping multi-business owners scale strategically and sustainably.

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.