-

admin@bestybookkeepers.com

-

Call Us M-F 9-5pm ET: 833-44-BESTY

Starting a new company is an exhilarating whirlwind of activity. You're juggling product development, marketing, sales, and a million other things that demand your immediate attention. In the midst of this controlled chaos, one of the most critical decisions you'll make is choosing the right software to track your bookkeeping. This decision might seem mundane compared to launching your first product or landing your first customer, but it's actually one of the most important foundational choices you'll make for your business.

Your bookkeeping software isn't just about tracking numbers; it's about laying the financial foundation for your business's future success. The right software will provide you with the clarity you need to make strategic decisions, manage your cash flow effectively, and stay compliant with tax laws. Making the right choice from the beginning can save you from costly migrations and countless headaches down the road.

Think of your bookkeeping software as the central nervous system of your business's finances. It's where every financial transaction is recorded, categorized, and reconciled. This data is then used to generate financial statements, such as the profit and loss statement and the balance sheet, which provide a snapshot of your company's financial health.

Without a reliable bookkeeping system, you're essentially flying blind. You won't have a clear picture of your profitability, your cash flow, or your overall financial position. This can lead to poor decision-making, missed opportunities, and even business failure. According to the Small Business Administration, poor financial management is one of the leading causes of business failure in the first five years.

The software you choose will also determine how easily you can work with accountants and bookkeepers. Most financial professionals have preferences for certain platforms, and choosing a widely-adopted solution can make it much easier to get professional help when you need it.

When it comes to bookkeeping software for new businesses, there are several key players that dominate the market. Each has its own strengths and weaknesses, and the best choice for your business will depend on your specific needs, budget, and growth plans. In this comprehensive guide, we'll examine the most popular options: QuickBooks Online, Xero, FreshBooks, Wave, and Zoho Books.

BESTY's Take: This is our top recommendation for most new businesses, especially those planning to grow or work with professional bookkeepers/accountants.

Best for: Most new businesses, especially those with plans to scale beyond $500K in annual revenue.

QuickBooks Online (QBO) is the undisputed industry standard for small business accounting software, and for good reason. It offers a comprehensive suite of features that can handle everything from basic invoicing and expense tracking to complex inventory management and payroll processing. The platform serves over 4.2 million subscribers worldwide and is the preferred choice for most accounting professionals.

Best For: Most new businesses, especially those planning to grow or work with professional bookkeepers/accountants.

Pricing: Starting at $30/month for Simple Start plan.

BESTY's Take: If QuickBooks didn't exist, Xero would be our go-to recommendation. It's QuickBooks' strongest competitor, offering a clean interface and powerful features.

Xero is particularly popular with businesses that have international operations or complex bank reconciliation needs.

Best For: Service-based businesses, companies with international operations, or businesses that need multiple users.

Pricing: Starting at $13/month for Early plan.

BESTY's Take: Perfect for freelancers and service-based businesses, but limited for product-based companies. FreshBooks was built specifically for service providers, and it shows.

The time tracking and invoicing features are top-notch, making it ideal for consultants, agencies, and freelancers.

Best For: Freelancers, consultants, agencies, and service-based businesses that need excellent time tracking and invoicing.

Pricing: Starting at $17/month for Lite plan.

BESTY's Take: Great for very small businesses with tight budgets, but you'll likely outgrow it as your business expands. The price is right, but there are trade-offs.

Wave offers basic accounting features for free, making it attractive for startups and very small businesses.

Best For: Very small businesses, startups with tight budgets, or businesses with simple accounting needs.

Pricing: Free for basic features, paid add-ons available.

BESTY's Take: Best for businesses already using other Zoho products or those who want an all-in-one business management solution. The integration with Zoho's other apps is its biggest strength.

If you're already using Zoho CRM, Zoho Projects, or other Zoho applications, Zoho Books can be a natural fit.

Best For: Businesses already in the Zoho ecosystem or those wanting comprehensive business management beyond just accounting.

Pricing: Starting at $10/month for Basic plan.

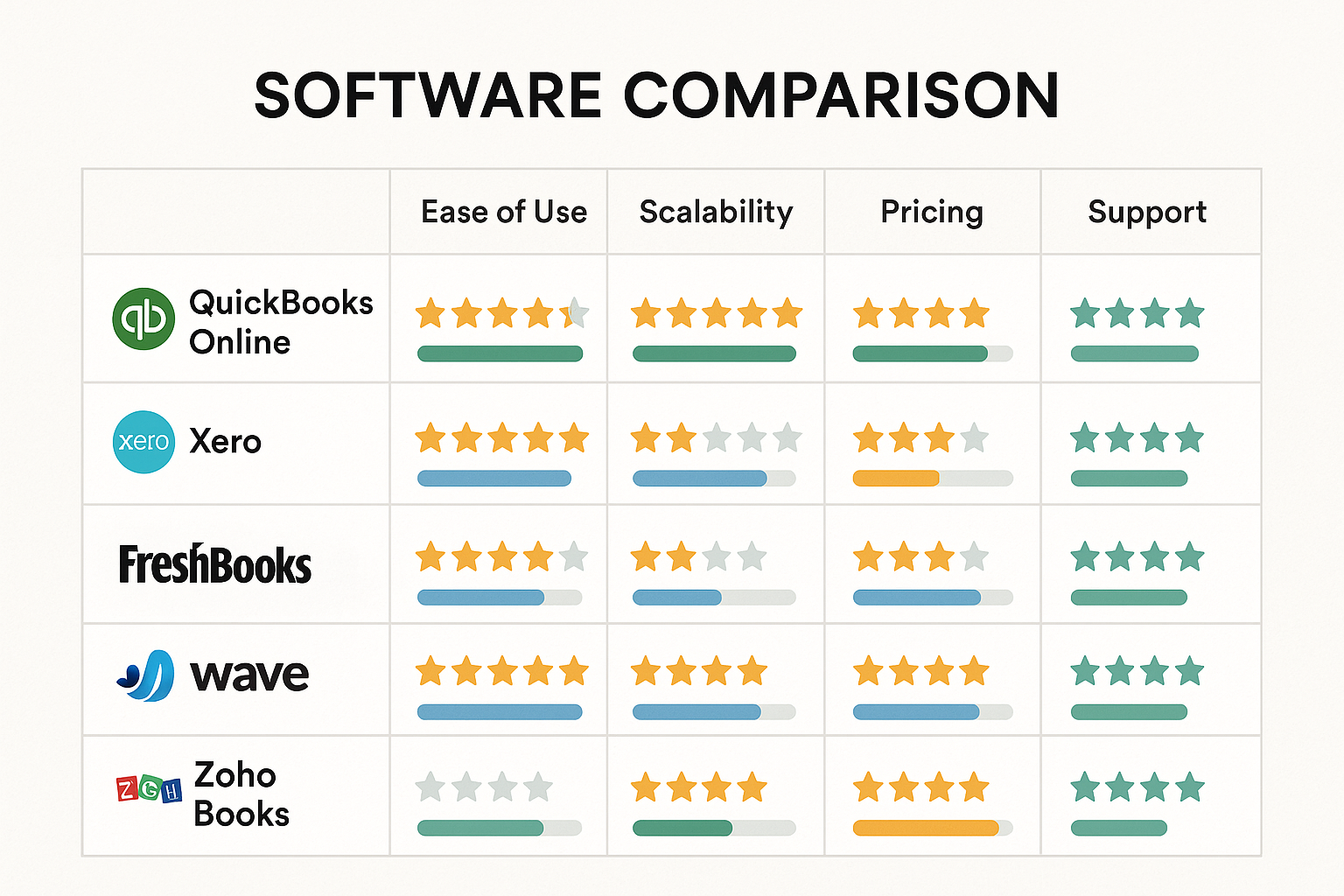

To help you make the best decision for your business, here's how these platforms stack up across key criteria:

| Software | Best For | Monthly Cost | Ease of Use | Scalability | Support Quality | Key Strength |

|---|---|---|---|---|---|---|

| QuickBooks Online | Most businesses | $30-$200 | Good | Excellent | Excellent | Comprehensive features |

| Xero | International businesses | $13-$70 | Excellent | Good | Good | User-friendly design |

| FreshBooks | Service providers | $17-$55 | Excellent | Limited | Good | Time tracking & invoicing |

| Wave | Budget-conscious startups | Free-$35 | Good | Limited | Basic | Free core features |

| Zoho Books | Zoho ecosystem users | $12-$40 | Fair | Good | Good | Integration & automation |

For most new businesses, I recommend starting with QuickBooks Online. Yes, it's more expensive, but the comprehensive features, widespread adoption, and professional support make it worth the investment.

If budget is tight, Xero offers excellent value with unlimited users and strong features.

Service-based businesses should seriously consider FreshBooks for its superior time tracking and invoicing capabilities.

Remember, the best accounting software is the one you'll actually use consistently. Don't get paralyzed by the decision – pick one and get started. You can always switch later as your business grows and your needs change.

Don't let software choice paralysis hold back your business growth.

At BESTY Bookkeepers, we'll help you choose the right software for your specific business needs and get it set up properly from day one. We work with all major platforms and can ensure your bookkeeping system grows with your business.

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.