-

admin@bestybookkeepers.com

-

Call Us M-F 9-5pm ET: 833-44-BESTY

I met a business owner at a networking event who had accidentally built the perfect business ecosystem.

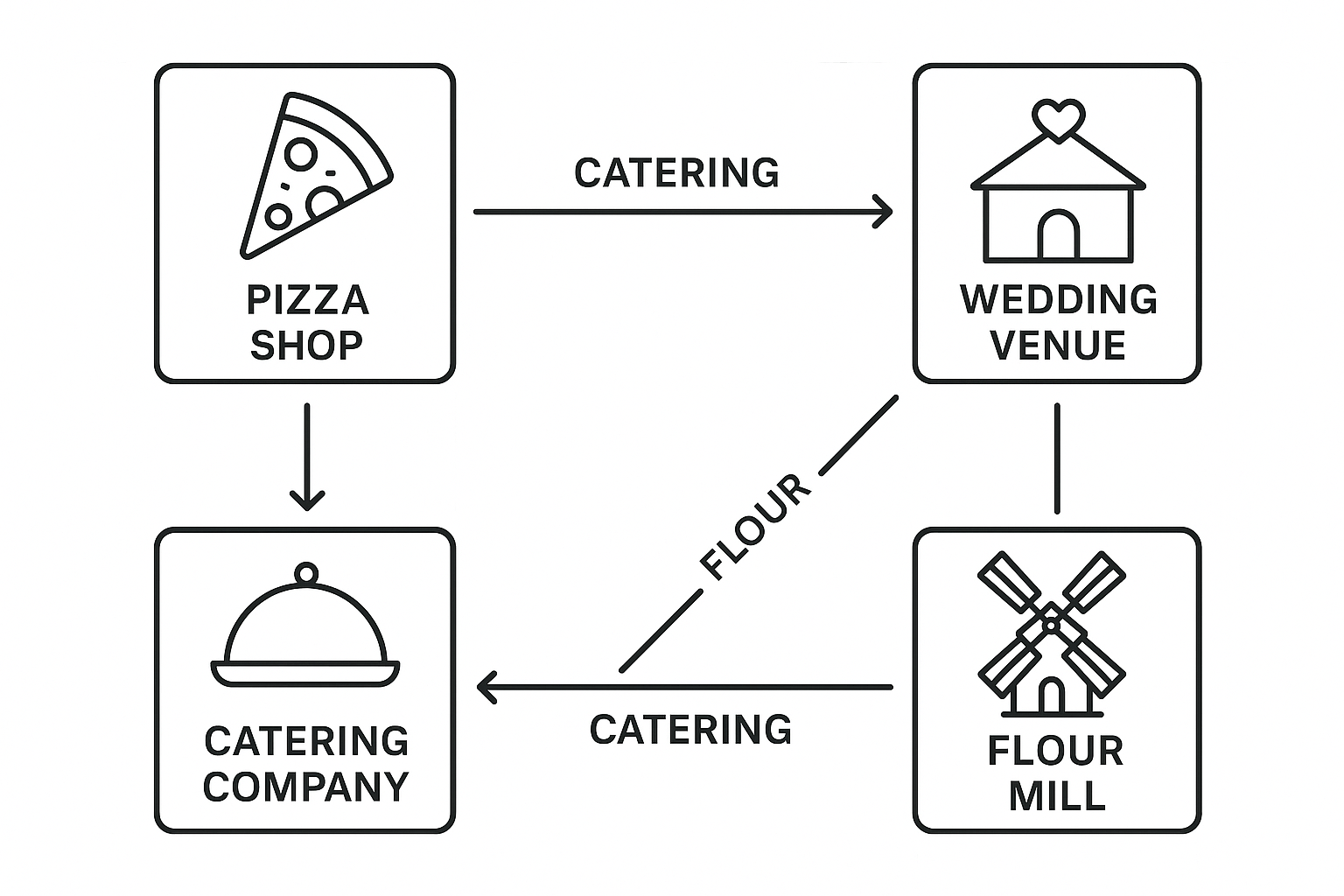

He owns a pizza shop, a catering company, a flour mill, and a wedding venue. The mill supplies flour to the pizza shop at cost, the pizza shop caters all the weddings at his venue, and the catering company uses his venue for big events.

It's a brilliant setup where everything feeds into everything else, creating a highly profitable and efficient operation.

But he was panicking.

Someone had mentioned the terrifying phrase “piercing the corporate veil,” and now he was convinced he was on the verge of losing all his legal protection. He was seriously considering blowing up his entire integrated system, thinking he needed to start charging his pizza shop full retail for flour from his own mill.

I had to talk him off the ledge. “Dude,” I said, “you're not doing anything wrong. You just need to clean up the paperwork.”

This fear is incredibly common among multi-business owners. The good news is that you can absolutely have your businesses work together and still maintain the legal protection of the corporate veil.

In this comprehensive guide, we'll break down what corporate veil protection means, how to protect it, and how to create a profitable, integrated business ecosystem the right way.

The corporate veil is a legal concept that separates the actions of a corporation (or LLC) from the actions of its shareholders or owners.

In simple terms, it's what prevents you, the business owner, from being held personally liable for the debts and legal troubles of your business.

If your business is sued or goes bankrupt, corporate veil protection shields your personal assets—your house, your car, your personal savings—from being used to satisfy the business's liabilities.

However, this protection isn't absolute. Courts can “pierce the corporate veil” if they find that the business is not a truly separate entity from its owner.

This can happen if you're not treating the business as a separate legal entity, such as by commingling personal and business funds or failing to follow corporate formalities.

The business owner I met is a perfect example of how powerful business integration can be.

By having his businesses work together, he's creating significant cost savings and revenue opportunities that wouldn't exist if they were operating independently.

His flour mill has a guaranteed customer in his pizza shop, his pizza shop gets a steady stream of catering gigs from his wedding venue, and his wedding venue has a reliable catering partner.

It's a win-win-win situation.

By reducing costs and creating new revenue streams between your businesses, you can significantly boost your bottom line. When your flour mill supplies your pizza shop at cost, you're eliminating the markup that would go to an external supplier.

Streamlining operations and creating synergies between businesses eliminates redundancies and creates operational efficiencies. Your catering company already knows your wedding venue inside and out, making setup and execution seamless.

Creating a unique and difficult-to-replicate business model gives you a significant competitive advantage. Competitors can't easily copy your integrated approach because they don't own all the pieces.

So, how do you enjoy the benefits of business integration without risking your personal assets?

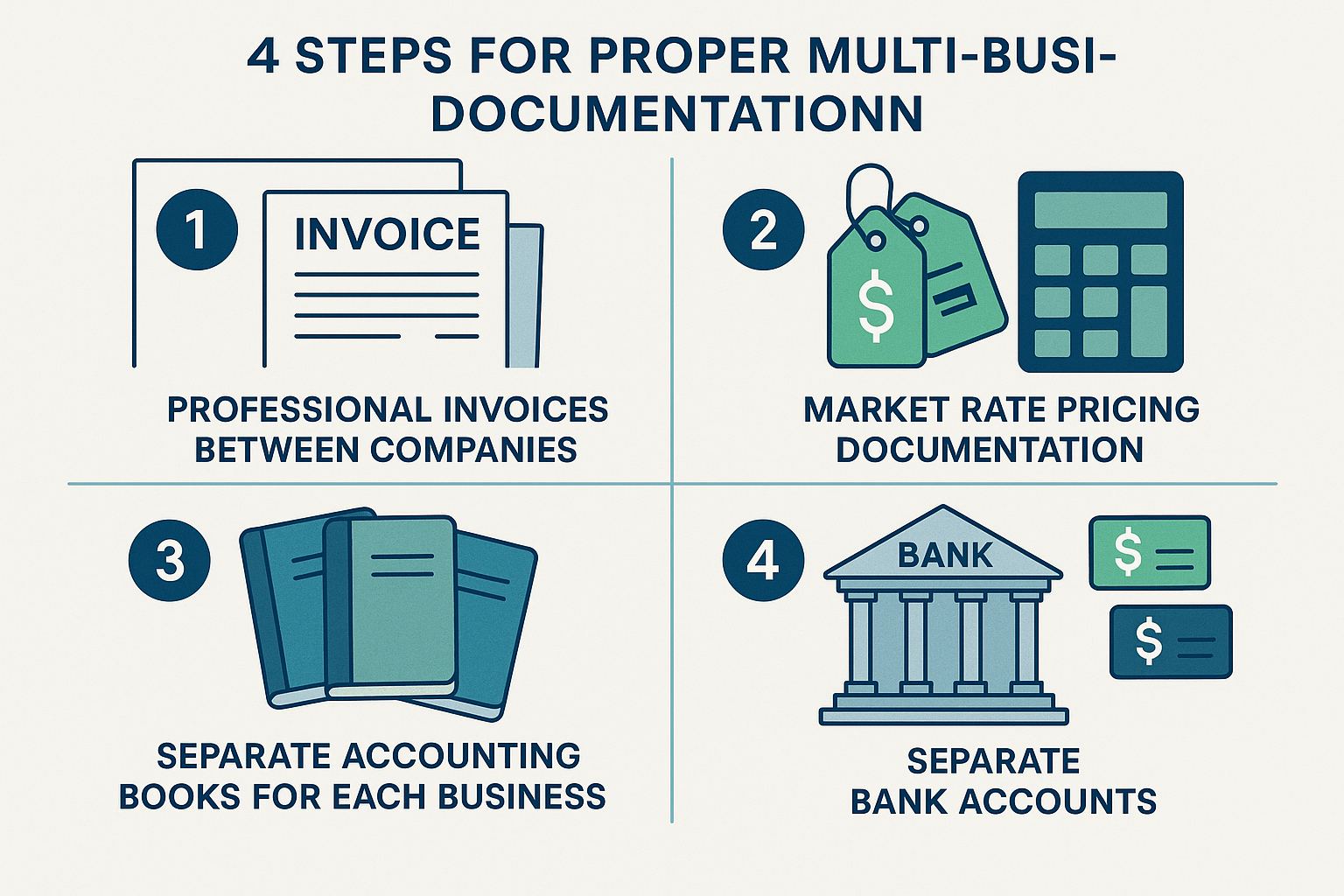

The key is to treat each business as a separate entity, even when they're working together. This means meticulous record-keeping and a clear paper trail for all inter-company transactions.

Treat each business like you would treat a business owned by your best friend – with respect, proper documentation, and fair pricing.

Here's exactly what you need to do:

Even if you own both businesses, you need to create invoices for every transaction between them. If the flour mill provides flour to the pizza shop, the mill needs to send an invoice to the pizza shop, and the pizza shop needs to pay it.

This creates a clear record of the transaction and shows that the two businesses are operating as separate entities.

Use professional invoicing software and maintain the same level of documentation you would with any external vendor or customer.

This is a big one. You can't just give your other businesses sweetheart deals that are significantly below market rates.

The transactions between your companies should be at “arm's length,” meaning they should be comparable to what you would charge an unrelated third party.

While some discounts are justifiable (e.g., for volume or preferred customer status), the pricing should be commercially reasonable. This is crucial for both legal and tax purposes.

Research market rates for similar services and document your pricing rationale in writing.

Small discounts (5-15%) are generally acceptable, but avoid pricing that's significantly below market value.

Each of your businesses needs its own set of books. You can't just lump all your income and expenses together.

Each company should have its own profit and loss statement, balance sheet, and chart of accounts.

This is essential for tracking the financial performance of each business and for demonstrating their separateness to the IRS and the courts.

This is one of the fastest ways to get into trouble. Each of your businesses must have its own separate bank account.

You should never use one business's bank account to pay the expenses of another, and you should never use your personal bank account for business expenses.

Commingling funds is a huge red flag for courts and can make it much easier for them to pierce the corporate veil.

Here are the most dangerous mistakes that can destroy your corporate veil protection:

The business owner I met doesn't need to blow up his profitable integrated system. He just needs to formalize the relationships between his businesses with proper documentation, fair pricing, and separate accounting.

When done correctly, business integration can be incredibly powerful. It can reduce costs, increase efficiency, and create competitive advantages that are difficult for competitors to replicate.

The key is to maintain the legal separateness of each business while allowing them to work together in a mutually beneficial way.

Don't let fear of piercing the corporate veil prevent you from maximizing your business potential.

📅 Book Your FREE Multi-Business Consultation Now

At BESTY Bookkeepers, we specialize in helping multi-business owners create profitable, legally compliant business ecosystems. We'll help you set up the proper documentation, accounting systems, and inter-company agreements to protect your corporate veil while maximizing your integrated business potential.

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.