-

admin@bestybookkeepers.com

-

Call Us M-F 9-5pm ET: 833-44-BESTY

In the world of entrepreneurship, the difference between seizing a game-changing opportunity and watching it pass by often comes down to one thing: liquidity. While your competitors are scrambling for capital, a well-stocked financial “war chest” allows you to act with speed, confidence, and strategic precision. This isn't just about having an emergency fund; it's about building a strategic weapon that fuels growth, mitigates risk, and gives you the power to make bold moves when the time is right.

For forward-thinking entrepreneurs, especially those managing multiple businesses, a financial war chest is the ultimate competitive advantage. It's the foundation that allows you to move from a reactive to a proactive mindset, turning market volatility into a strategic opportunity. As a study by U.S. Bank revealed, a staggering 82% of small businesses fail due to cash flow issues—not because of a lack of demand, but because they lacked the financial reserves to navigate the unpredictable landscape of business.

A financial war chest is a strategic reserve of capital specifically set aside for high-impact business moves. Unlike an emergency fund, which is purely defensive, a war chest is both offensive and defensive. It protects your business during downturns while simultaneously positioning you to capitalize on opportunities that your less-prepared competitors are forced to ignore.

“A financial war chest isn't just a high-balance savings account, it's a strategic reserve of capital designed for liquidity, opportunity, and protection.” — WealthFactory

For multi-business owners, the need for a war chest is even more critical. With multiple entities to manage, cash flow can be complex and unpredictable. A centralized war chest provides the flexibility to allocate capital where it's needed most, whether it's shoring up one business during a slow period or funding a high-growth initiative in another.

Building a financial war chest is not a sign of conservative thinking; it's a hallmark of strategic leadership. Here are the key advantages it provides:

| Advantage | Description |

|---|---|

| Opportunity Seizing | Acquire a competitor, invest in new technology, or expand into a new market when the opportunity arises. |

| Market Resilience | Navigate economic downturns, supply chain disruptions, and unexpected market shifts without resorting to debt. |

| Negotiation Power | Negotiate better terms with suppliers, lenders, and potential partners from a position of financial strength. |

| Talent Acquisition | Attract and retain top talent, even during market downturns when competitors are cutting back. |

| Strategic Flexibility | Pivot your business model, launch new products, or make other strategic adjustments with the confidence that you have the capital to see it through. |

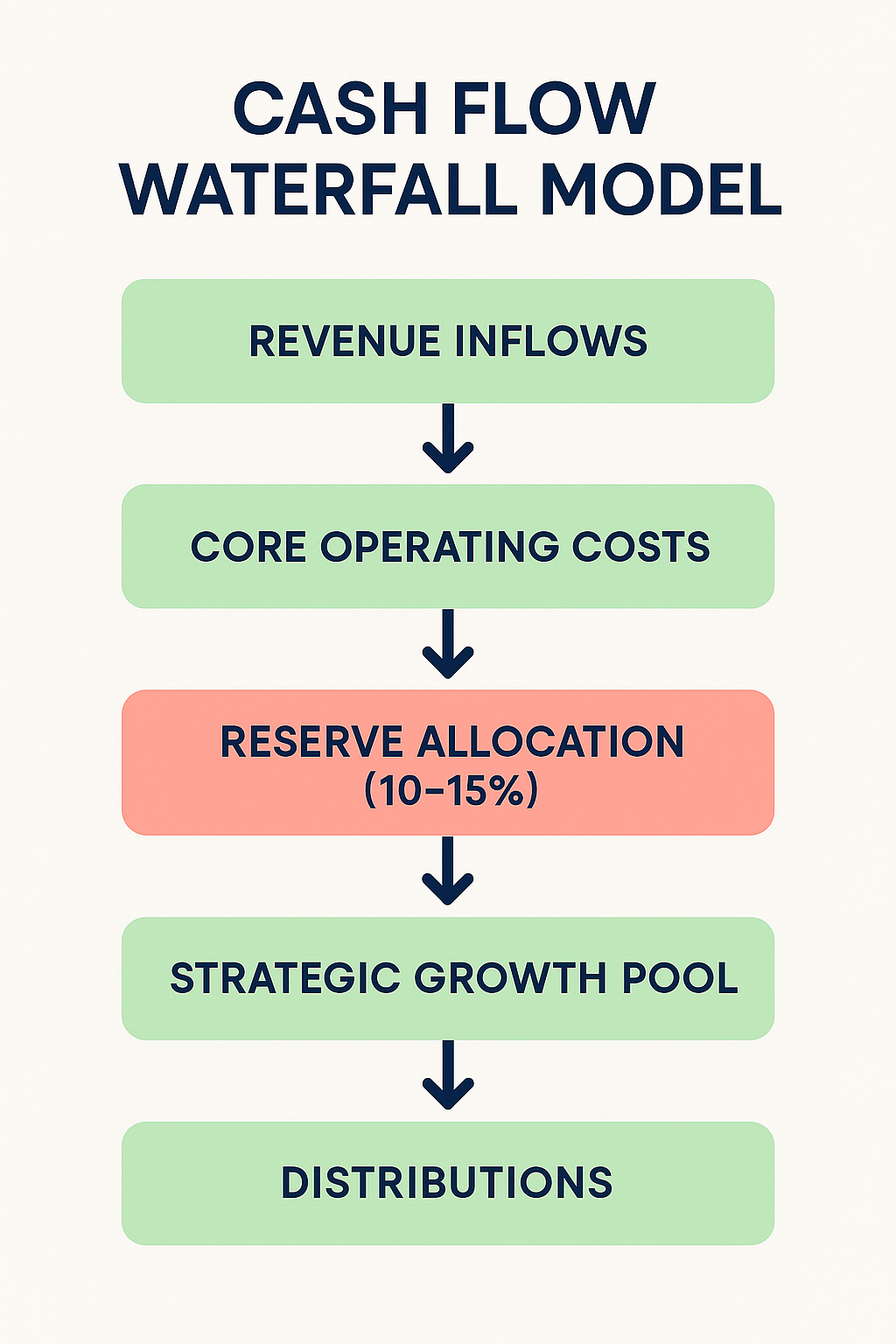

Building a war chest requires a disciplined, systematic approach to cash flow management. One of the most effective frameworks is the Cash Flow Waterfall Model, which prioritizes structured cash allocation and reserve building. This model, adapted from liquidity planning strategies highlighted in the Harvard Business Review, ensures that you're consistently building your reserves without compromising your core operations.

Here's how it works:

This disciplined approach turns cash management from a reactive chore into a proactive, strategic advantage. The Harvard Business Review recommends that companies maintain 6-12 months of operating reserves, particularly during periods of economic uncertainty or aggressive expansion.

At BESTY Bookkeepers, we see too many business owners who are so focused on the day-to-day that they miss the bigger picture. Your bookkeeping isn't just about tracking expenses; it's about generating the financial clarity you need to make strategic decisions. Building a financial war chest is the bridge between solid bookkeeping and high-level fractional CFO strategy.

Our approach is designed for multi-business owners who are ready to move beyond basic bookkeeping and start using their financials as a strategic weapon. We help you:

Don't wait for the next crisis or missed opportunity to start thinking about your financial reserves. The time to build your war chest is now, when your business is strong and your opportunities are abundant.

Let BESTY Bookkeepers help you implement a strategic cash flow system that builds your reserves while optimizing your operations. Our fractional CFO approach bridges the gap between bookkeeping and strategic financial leadership.

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.