-

admin@bestybookkeepers.com

-

Call Us M-F 9-5pm ET: 833-44-BESTY

As the owner of a bookkeeping company, I get a front-row seat to the financial habits of hundreds of business owners. I see the same patterns, the same anxieties, and the same mistakes over and over again. But there's one that consistently baffles me.

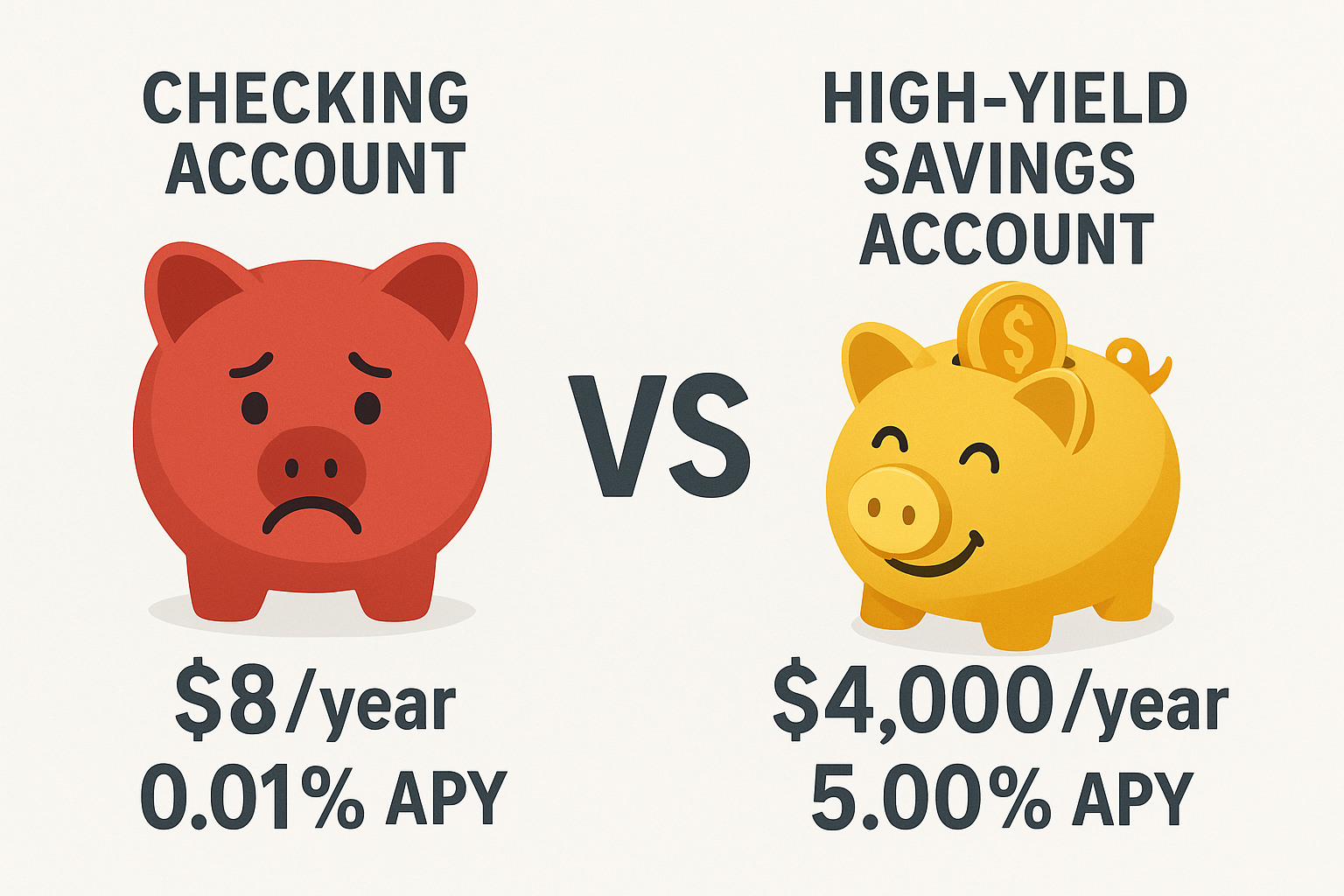

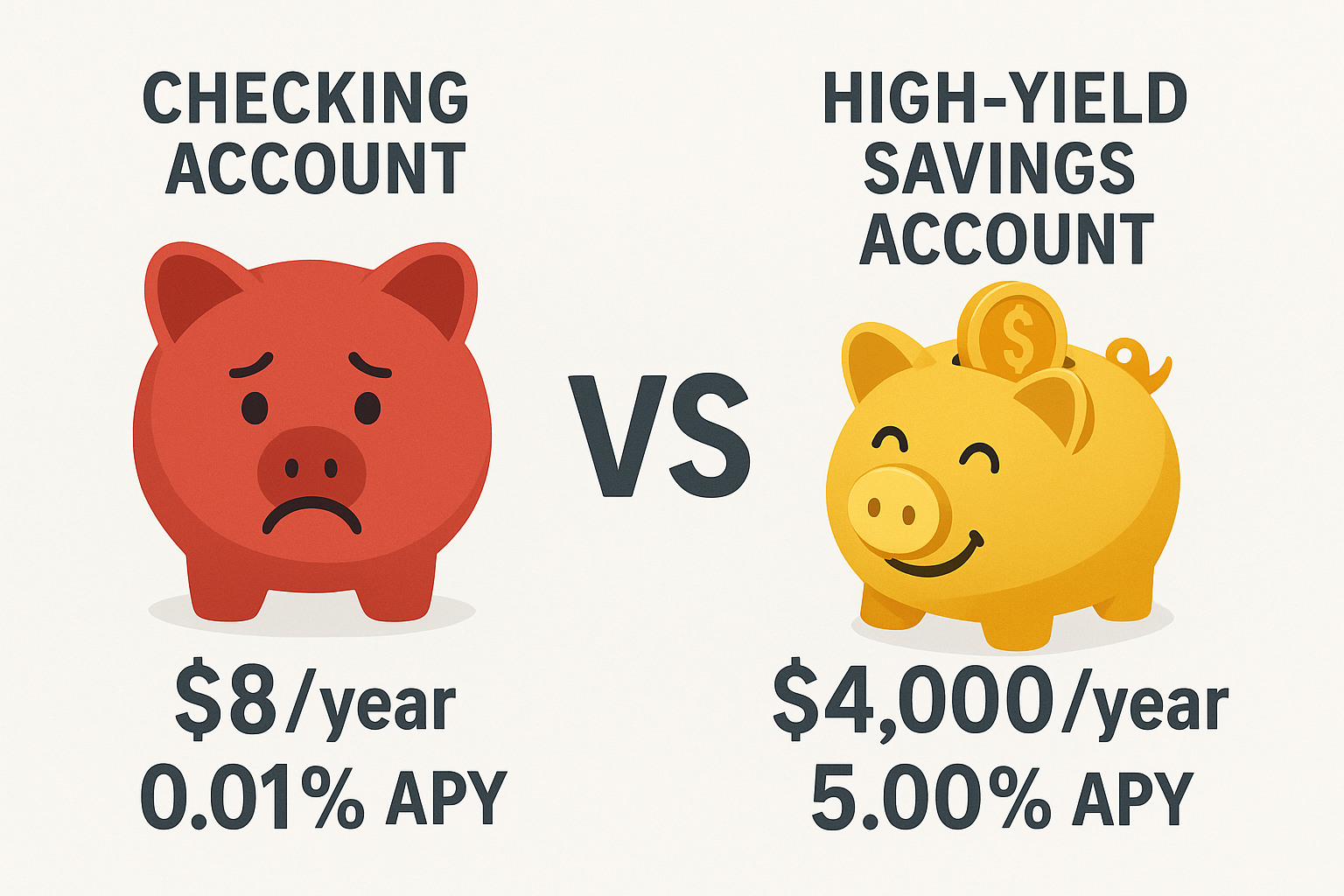

Business owners will agonize over a $200 monthly software subscription, but think nothing of letting $80,000 sit in a checking account earning virtually nothing.

Let that sink in. The mental energy spent debating a minor operational expense, while thousands of dollars in potential earnings are silently slipping away. It's a paradox that I see every single day, and it's costing businesses a fortune.

Let's do the math. It's simple, but the implications are staggering.

This image perfectly captures what I see every day in business bank statements. Money sitting there, earning practically nothing, while inflation quietly eats away at its purchasing power.

But here's what most business owners don't realize: there's a simple alternative that could transform their financial picture overnight.

Here's the comparison that will change how you think about your business cash forever:

By keeping money in checking, you're losing $3,992 per year

That's $333 every single month walking out the door

That's not a fee your bank charges; it's the opportunity cost of your money doing nothing. For many businesses, that's more than a month of rent, a key employee's bonus, or the marketing campaign you've been putting off.

If the math is so simple, why is this such a common issue? Over the years, I've found it boils down to a few key psychological factors:

This isn't about complex investment strategies or taking on unnecessary risk. This is about basic financial hygiene. Here's a simple, 20-minute plan to fix this problem for good:

Your money should be working for you, not the other way around. By letting large sums of cash sit idle in a checking account, you're not just missing out on potential earnings; you're actively eroding the value of your hard-earned capital through inflation.

If you're reading this and feeling a pang of recognition, don't worry. You're not alone. But now you have a simple, actionable plan to fix it. And if you're still not sure where to start, that's what we're here for.

At BESTY Bookkeepers, we help business owners achieve financial clarity and build systems that make their money work for them.

📅 Book Your FREE Consultation Now

Let's make sure your checking account isn't costing you more than your rent.

with X-Ray Vision 👀

💰 Find $500 to $25,000+

Hiding in Your Books Right Now!

Our software and CFO expert find hidden money and missed tax deductions in your QuickBooks or Xero.

🔍 AI + Expert CPA Review

💡 Find missed deductions

⚡ Just $99 for huge savings

💰 Stop letting money slip through the cracks!

by Emily Handren, M.S.

📚 101 Bookkeeping & CFO Mistakes You Can't Afford to Make. Discover the critical financial mistakes that destroy businesses and learn how to avoid them.

⭐ Essential reading for business owners

BFF: Besty Financial Forecaster

💼 Your Business's New Best Friend

💰 Instant Break-Even Calculator

📊 Professional Financial Ratios

💡 Smart Pricing Optimizer

⭐ Trusted by 1000+ business owners

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.