-

admin@bestybookkeepers.com

-

Call Us M-F 9-5pm ET: 833-44-BESTY

As a successful multi-business owner, you've poured your heart, soul, and countless hours into building your empire. The day will eventually come when you decide to reap the rewards of your hard work by selling one of your businesses. When that time comes, you'll want to get the absolute best price possible. While you might think that your brand, customer list, or proprietary technology are what buyers will value most, the truth is that the foundation of a top-dollar sale is something far less glamorous: your bookkeeping.

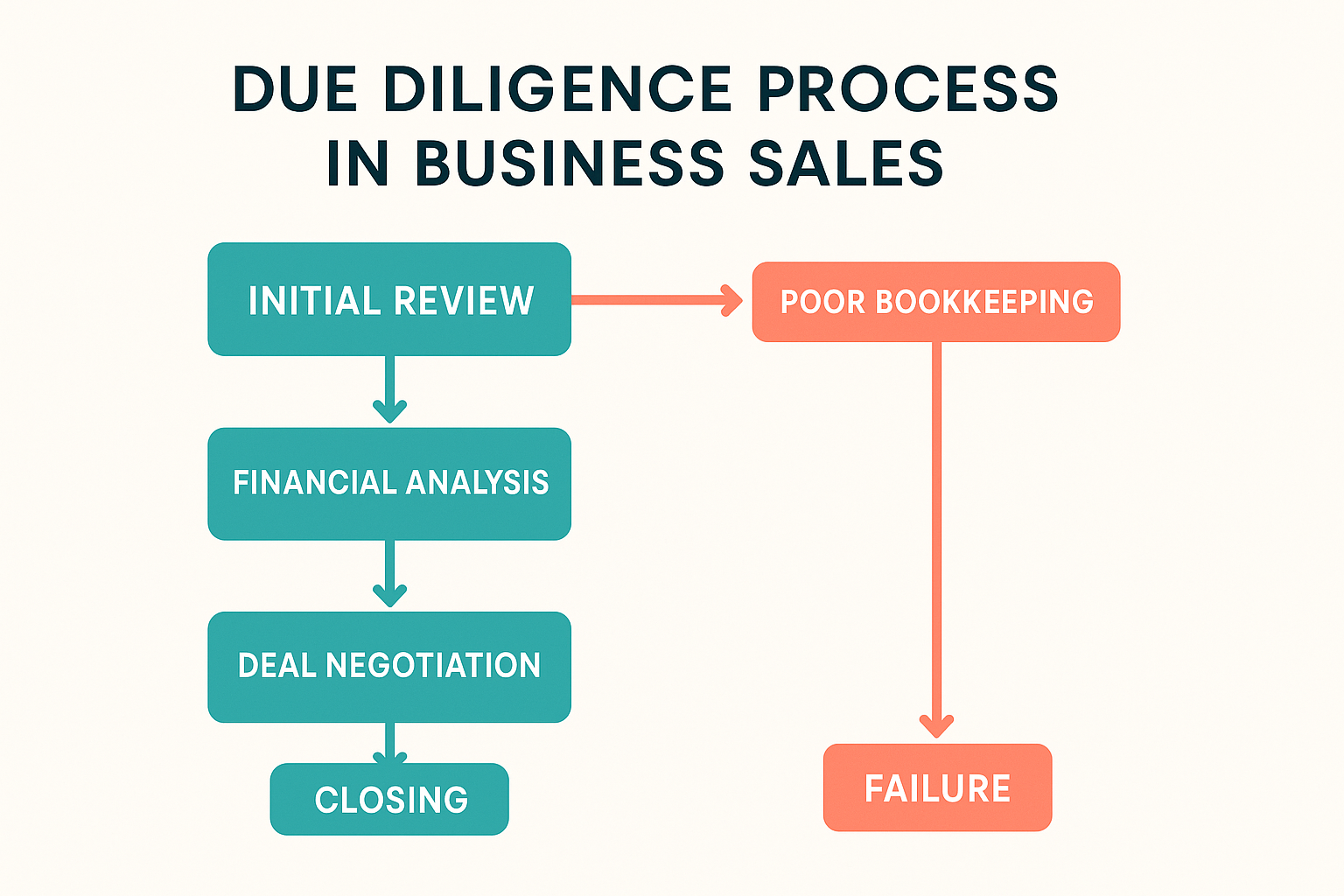

Many entrepreneurs treat bookkeeping as a chore, a necessary evil to get through tax season. But when it comes to selling your business, your financial records are the single most important factor in determining its value. In fact, a staggering 70-90% of M&A (mergers and acquisitions) failures are due to a lack of proper due diligence, which is almost always rooted in poor financial records [1]. Buyers aren't just buying your product or service; they're buying your cash flow, and if they can't verify it, they won't pay top dollar for it.

Imagine a potential buyer asks to see your financial statements, and you hand them a shoebox full of receipts and a collection of disorganized spreadsheets. What message does that send? It screams disorganization, risk, and a lack of control. Buyers will immediately assume you're hiding something, and their offer will reflect that risk.

“When buyers look at your business, the first thing they want to see is clean, reliable financials. If your books are messy, outdated, or unclear, you're leaving money on the table—and possibly scaring away serious buyers altogether.” – Keystone CPA [2]

Here are the tangible ways that poor bookkeeping can tank your sale price:

| Bookkeeping Mistake | Impact on Sale Price |

|---|---|

| Inconsistent Records | Buyers can't verify your revenue and profit claims, leading to a lower valuation multiple. |

| Mixing Personal & Business Expenses | This makes it impossible to determine the true profitability of the business, forcing buyers to guess low. |

| Poor Cash Flow Management | Unpredictable cash flow is a major red flag for buyers and lenders, reducing the number of potential offers. |

| Inaccurate Financial Statements | If your P&L, balance sheet, and cash flow statements don't match your tax returns, buyers will lose trust instantly. |

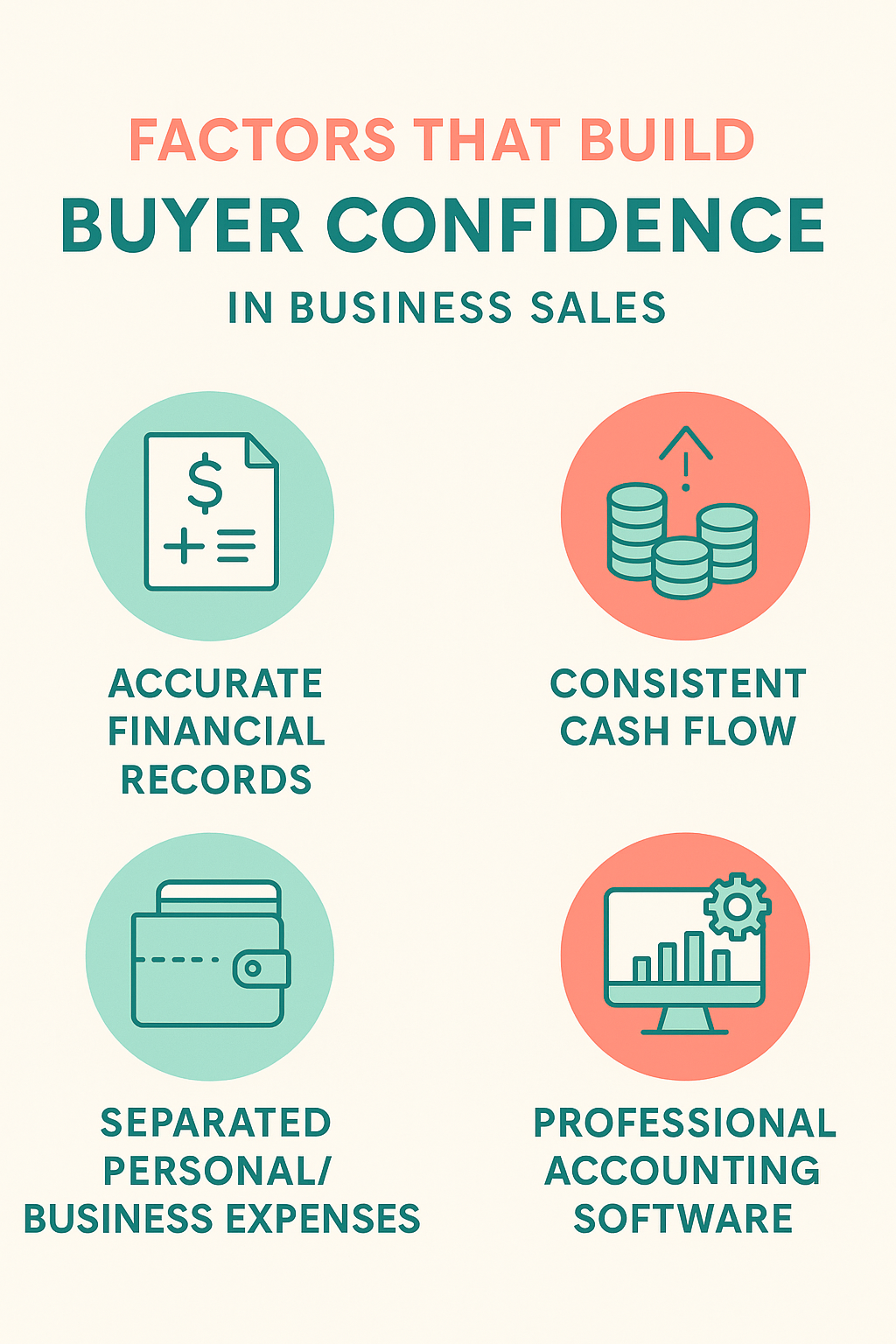

Now, let's flip the script. When you present a potential buyer with clean, accurate, and well-organized financial records, you're not just showing them numbers; you're demonstrating that your business is a well-oiled machine. This builds trust and confidence, which directly translates to a higher sale price.

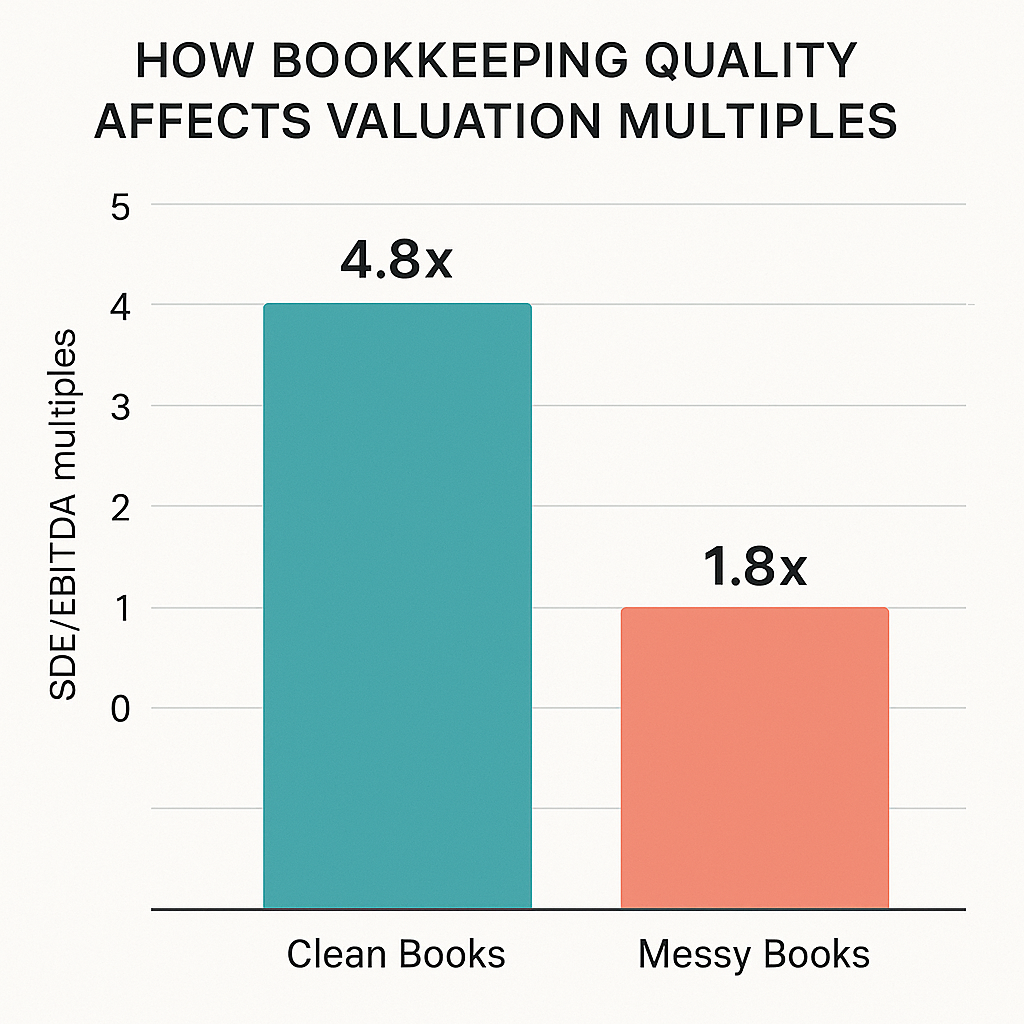

Clean books are the foundation for a higher valuation multiple. Your business will likely be valued on a multiple of its profit, such as Seller's Discretionary Earnings (SDE) or EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). With clean books, that profit number is clear and verifiable, justifying a higher multiple. Messy books, on the other hand, lead to lower multiples as buyers hedge against the unknown.

So, what exactly do “clean books” look like? Here's a checklist to get you started:

At BESTY Bookkeepers, we understand that you're busy running your businesses. You don't have time to become a bookkeeping expert. That's where we come in. We're not just bookkeepers; we're your strategic partners in building a more valuable and sellable business.

Our team of expert bookkeepers and fractional CFOs can help you clean up your books, establish solid financial processes, and provide you with the financial clarity you need to make smart, data-driven decisions. We'll help you prepare for a future sale by ensuring your financials are pristine, so you can confidently command top dollar.

Don't wait until you're ready to sell to get your books in order. Start today, and you'll not only be building a more valuable business, but you'll also be creating a more profitable and sustainable one for the long term.

Ready to discover what's hiding in your books? Our MoneyMatchIQ service finds the money you're missing.

[1] CFA Institute. (2025, February 3). What's the Winning Ingredient in M&A? The Answer Lies in Due Diligence. https://blogs.cfainstitute.org/investor/2025/02/03/whats-the-winning-ingredient-in-ma-the-answer-lies-in-due-diligence/

[2] Keystone CPA. (2025, September 29). Clean Books, Big Offers: Why Financial Clarity Increases Your Business Value. https://keystone.cpa/2025/09/29/clean-books-big-offers-why-financial-clarity-increases-your-business-value/

[3] Viking Mergers & Acquisitions. (2023, March 22). M&A Deal Killer Series 5: Poor Bookkeeping. https://www.vikingmergers.com/blog/deal-killer-series-5-innacurate-or-poor-bookkeeping/

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.